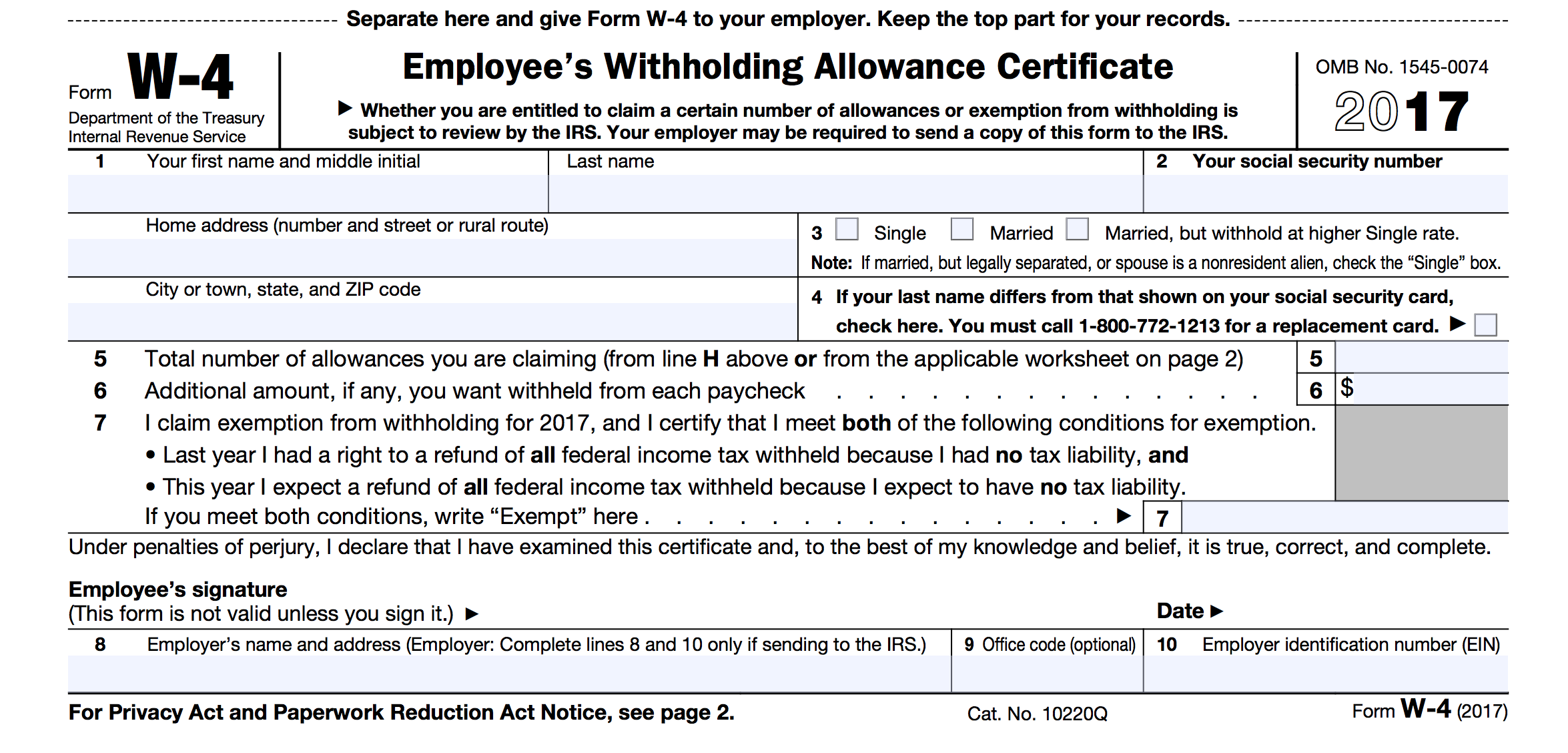

The W-4 form is an important document used by employees to indicate their tax withholding preferences to their employers. Understanding how to properly fill out the W-4 form is crucial for ensuring accurate tax calculations and avoiding any potential issues with the Internal Revenue Service (IRS).

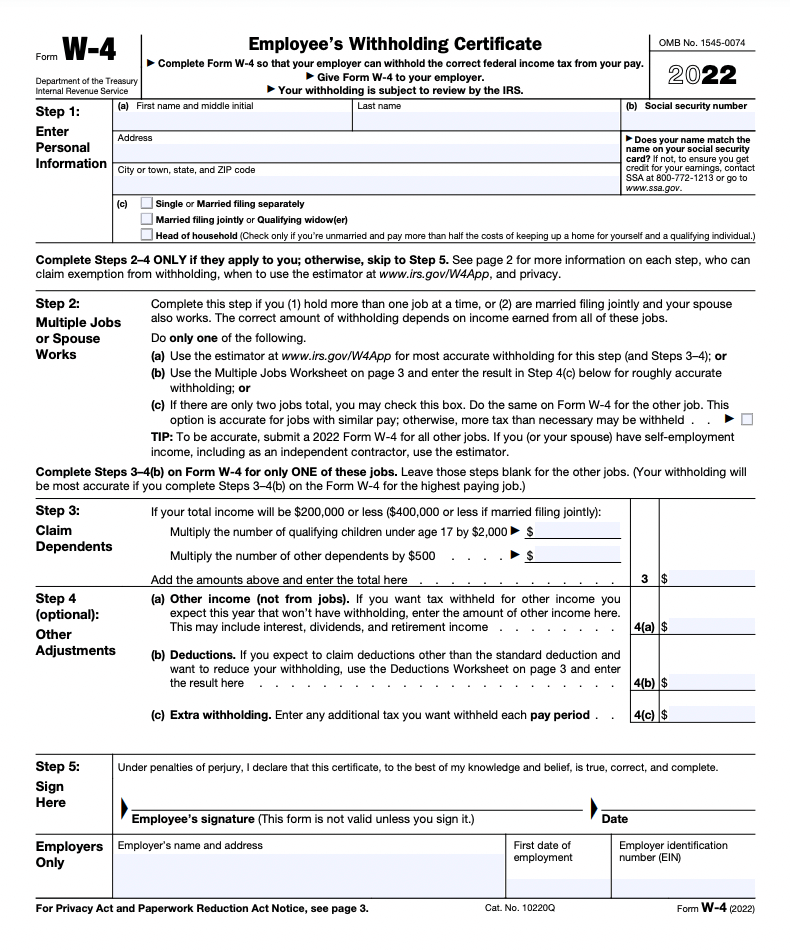

W-4 Form 2022 Printable

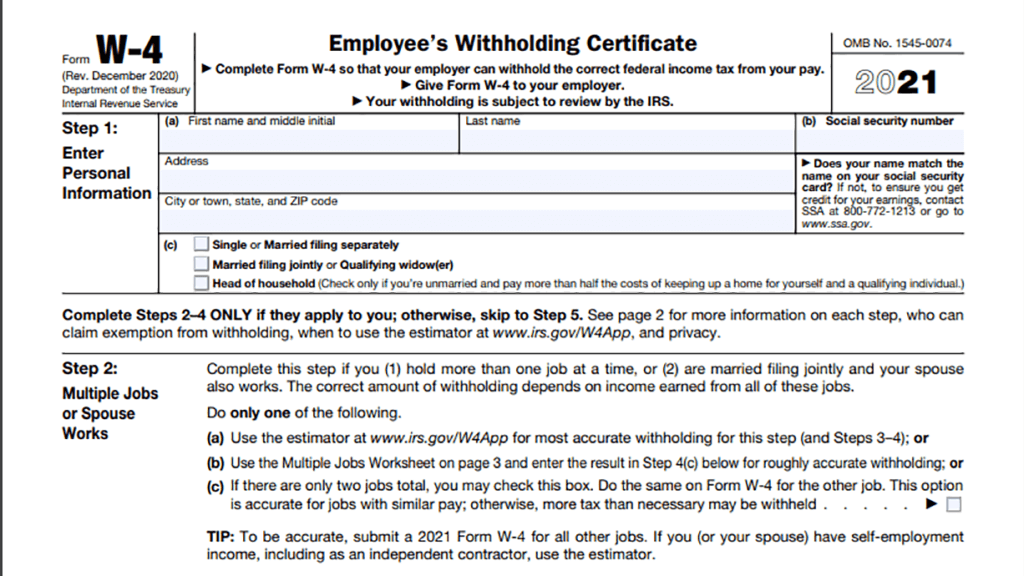

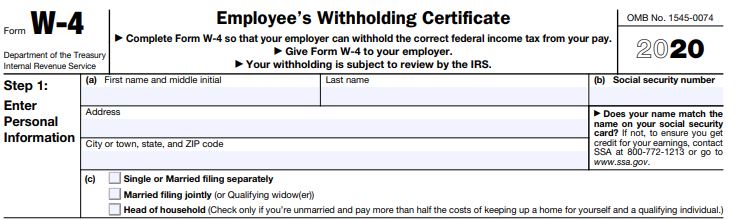

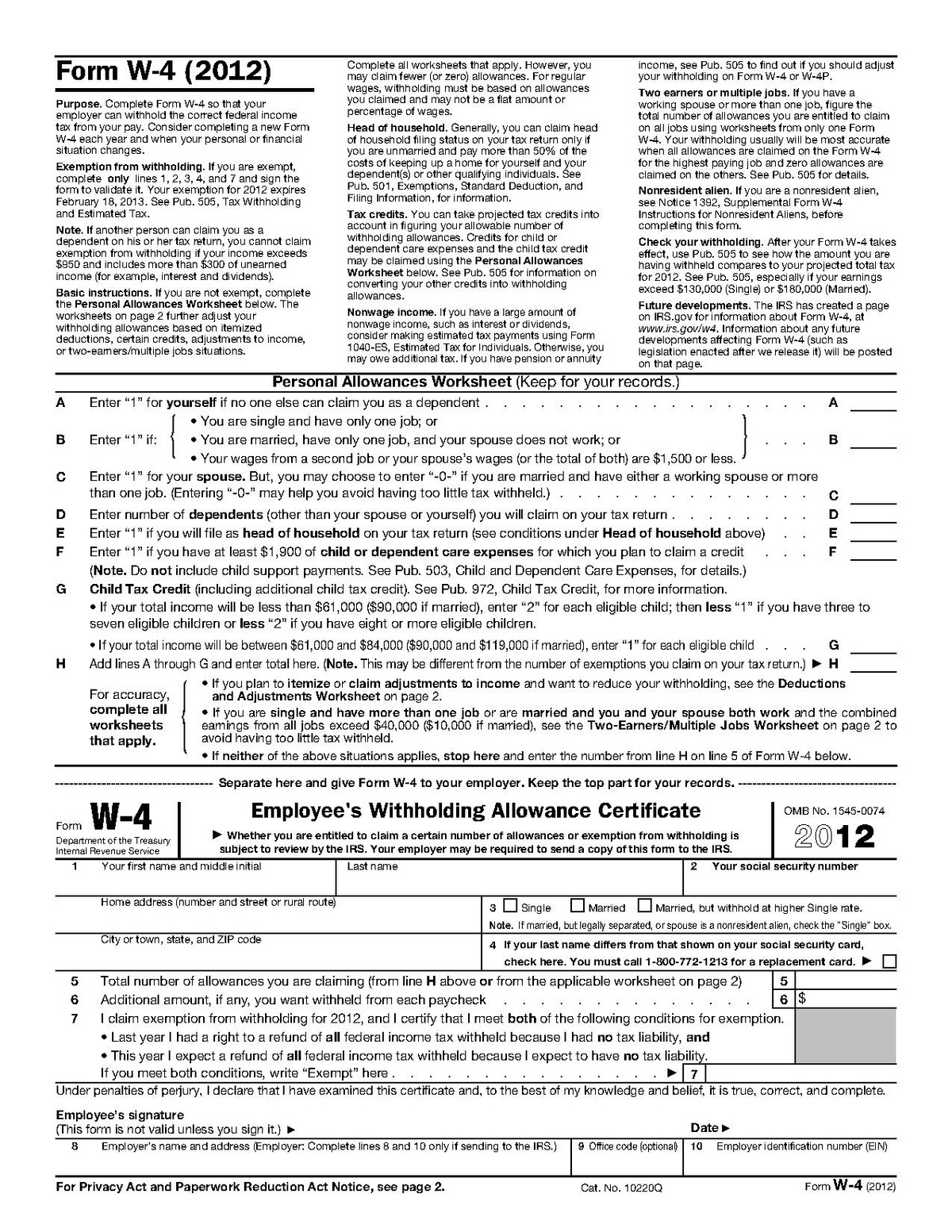

One of the key aspects of the W-4 form is declaring your filing status. This determines the applicable tax rates and deductions that will be used to calculate your withholding amount. The form provides options for single, married filing jointly, married filing separately, and head of household. It is important to choose the correct filing status to ensure accurate withholding.

One of the key aspects of the W-4 form is declaring your filing status. This determines the applicable tax rates and deductions that will be used to calculate your withholding amount. The form provides options for single, married filing jointly, married filing separately, and head of household. It is important to choose the correct filing status to ensure accurate withholding.

Tax Information · Career Training USA · InterExchange

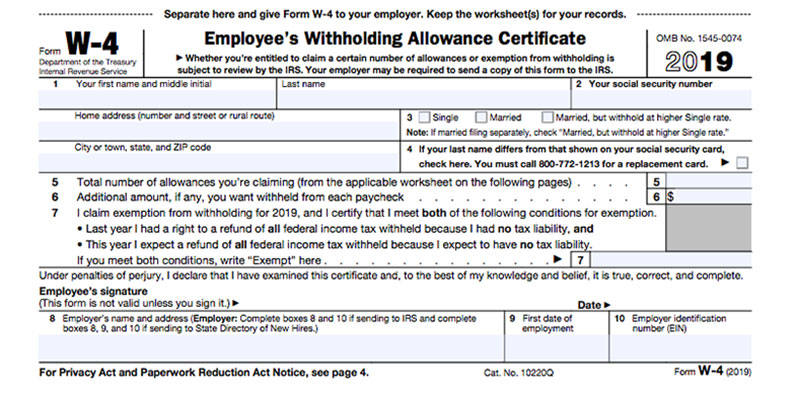

Another key component of the W-4 form is claiming allowances. Each allowance reduces the amount of income subject to withholding. The more allowances you claim, the less tax will be withheld from your pay. However, it is important to note that claiming too many allowances could result in not enough tax being withheld throughout the year, potentially leading to a tax bill when you file your return.

Another key component of the W-4 form is claiming allowances. Each allowance reduces the amount of income subject to withholding. The more allowances you claim, the less tax will be withheld from your pay. However, it is important to note that claiming too many allowances could result in not enough tax being withheld throughout the year, potentially leading to a tax bill when you file your return.

W 4 Forms Printable - Printable Forms Free Online

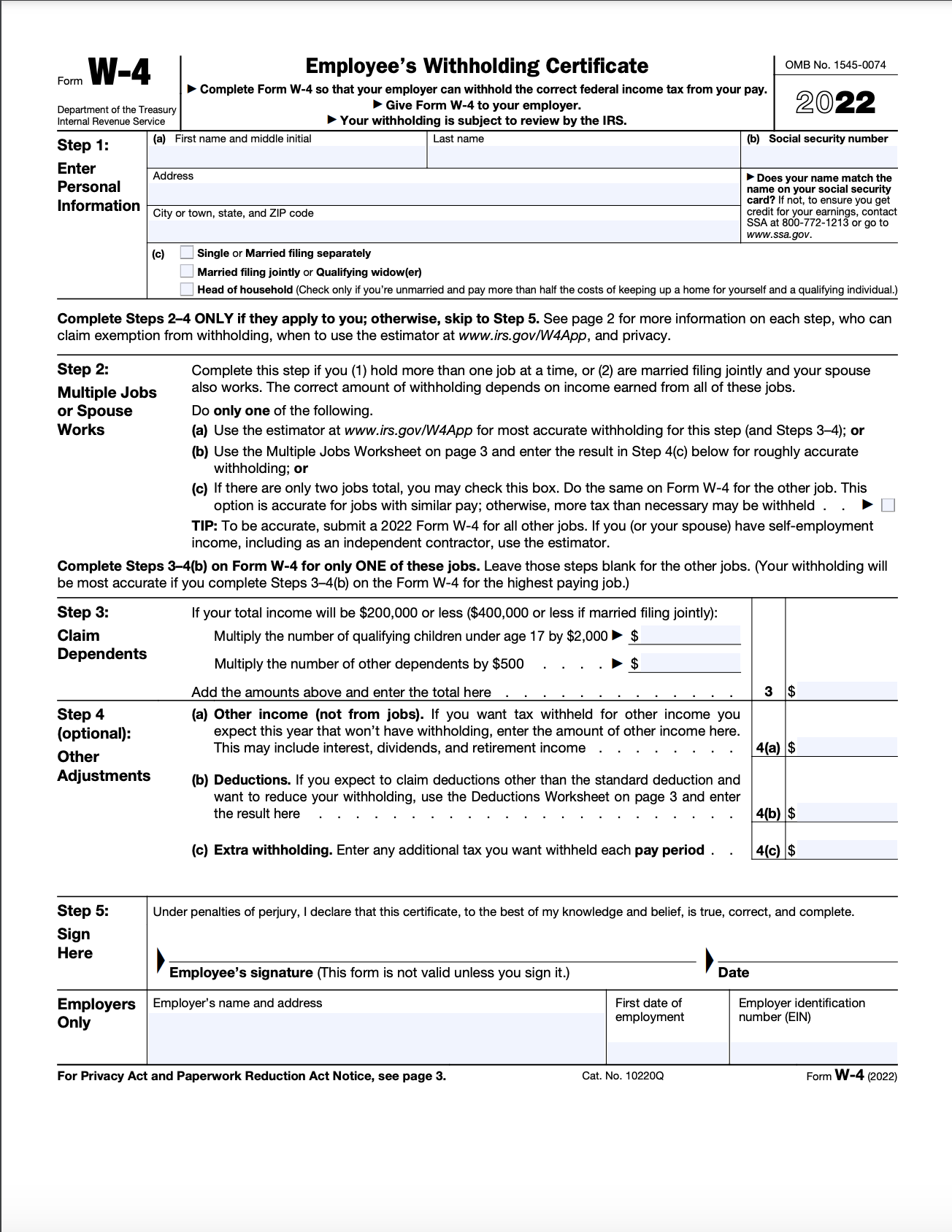

The updated W-4 form for 2022 includes a simplified design and clear instructions to assist employees in completing it accurately. It is available for free download and can be filled out online or printed for manual completion. Having the ability to access the form online is convenient and enables easy updates when necessary.

The updated W-4 form for 2022 includes a simplified design and clear instructions to assist employees in completing it accurately. It is available for free download and can be filled out online or printed for manual completion. Having the ability to access the form online is convenient and enables easy updates when necessary.

Printable W 4 Form Minnesota - Printable Forms Free Online

Employees in Minnesota should pay special attention to state-specific requirements when filling out their W-4 form. Minnesota has its own withholding tax rules and employers may require additional information or documentation. It is important to be aware of these specific requirements to avoid any discrepancies or penalties.

Employees in Minnesota should pay special attention to state-specific requirements when filling out their W-4 form. Minnesota has its own withholding tax rules and employers may require additional information or documentation. It is important to be aware of these specific requirements to avoid any discrepancies or penalties.

What is W4 Form? & How to Fill? - AccountsConfidant

Completing the W-4 form accurately is essential for ensuring that the correct amount of taxes is withheld from your paycheck. It is important to carefully follow the instructions provided on the form and provide accurate information about your filing status, allowances, and any additional withholding amounts. Incorrectly completed forms may result in underpayment or overpayment of taxes.

Completing the W-4 form accurately is essential for ensuring that the correct amount of taxes is withheld from your paycheck. It is important to carefully follow the instructions provided on the form and provide accurate information about your filing status, allowances, and any additional withholding amounts. Incorrectly completed forms may result in underpayment or overpayment of taxes.

IRS Form W4 2022 - W4 Form 2022 Printable

It is important to review and update your W-4 form whenever there are changes in your personal or financial circumstances. These changes may include getting married or divorced, having children, or experiencing a significant change in income. By ensuring that your W-4 form is up to date, you can avoid any surprises when it comes time to file your tax return.

It is important to review and update your W-4 form whenever there are changes in your personal or financial circumstances. These changes may include getting married or divorced, having children, or experiencing a significant change in income. By ensuring that your W-4 form is up to date, you can avoid any surprises when it comes time to file your tax return.

W4 Form 2022 - W-4 Forms - TaxUni

Overall, understanding the W-4 form and how to properly fill it out is essential for managing your tax withholdings. By accurately completing this form, you can avoid underpayment penalties or overpaying on your taxes throughout the year. It is always a good idea to seek guidance from a tax professional if you have any questions or are unsure about how to complete the form correctly.

Overall, understanding the W-4 form and how to properly fill it out is essential for managing your tax withholdings. By accurately completing this form, you can avoid underpayment penalties or overpaying on your taxes throughout the year. It is always a good idea to seek guidance from a tax professional if you have any questions or are unsure about how to complete the form correctly.

What Is Form W-4 and How to Fill It In in 2022?

Remember, it is your responsibility as an employee to ensure that your tax withholdings are accurate. By taking the time to understand the W-4 form and filling it out properly, you can avoid any potential issues and ensure that you are not overpaying or underpaying on your taxes.

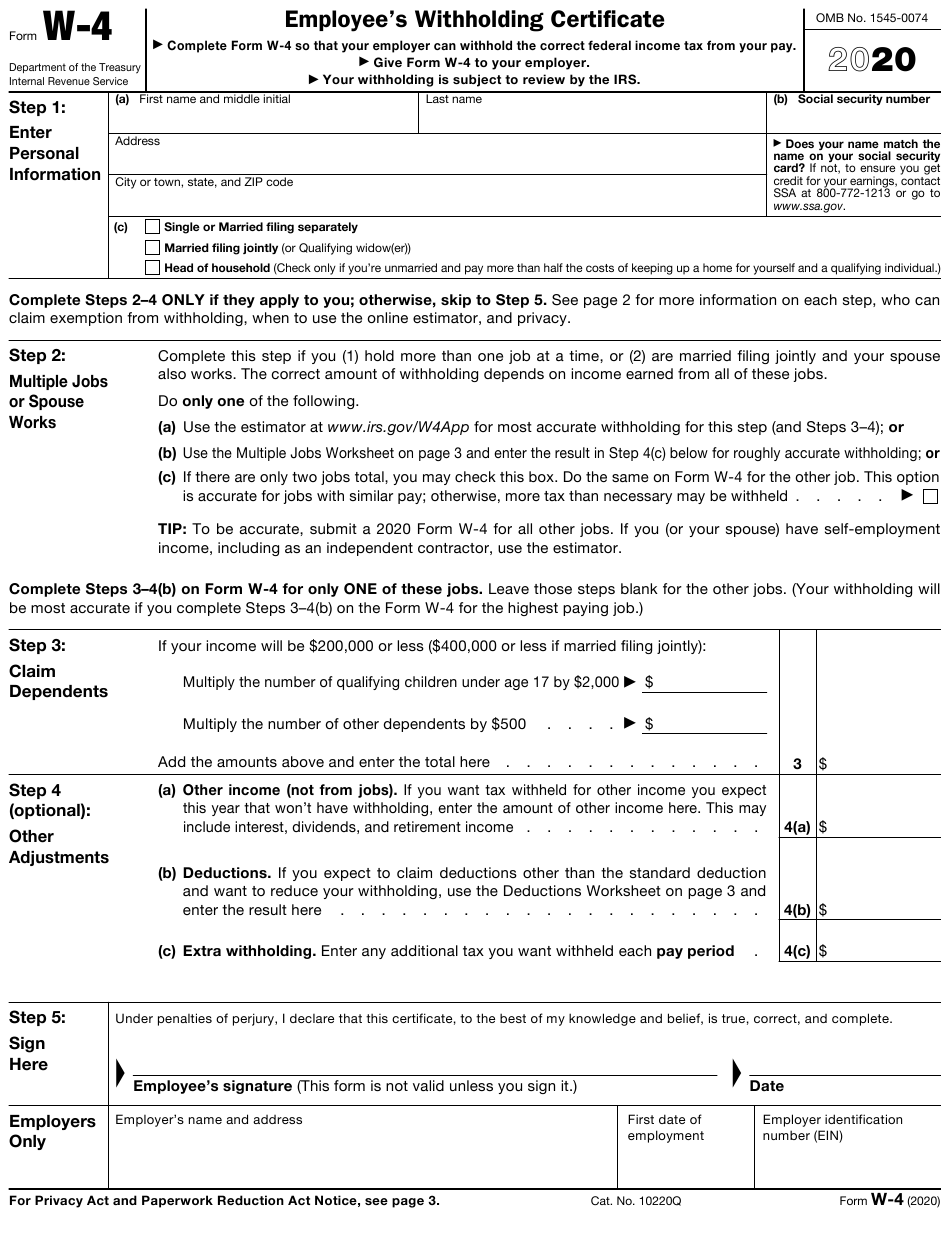

W-4 2020 Form Printable - 2022 W4 Form

Keep in mind that tax laws and regulations can change over time, so it is important to stay informed and aware of any updates or revisions to the W-4 form. The IRS provides resources and FAQs on their website to assist taxpayers in understanding and completing the W-4 form correctly.

Keep in mind that tax laws and regulations can change over time, so it is important to stay informed and aware of any updates or revisions to the W-4 form. The IRS provides resources and FAQs on their website to assist taxpayers in understanding and completing the W-4 form correctly.

W 4 Forms Free - 2022 W4 Form

In conclusion, the W-4 form plays a crucial role in calculating your tax withholdings. It is essential to understand the form and fill it out accurately to ensure that you are not underpaying or overpaying your taxes. By staying informed and seeking guidance when needed, you can navigate the W-4 form with confidence and ensure compliance with tax regulations.

In conclusion, the W-4 form plays a crucial role in calculating your tax withholdings. It is essential to understand the form and fill it out accurately to ensure that you are not underpaying or overpaying your taxes. By staying informed and seeking guidance when needed, you can navigate the W-4 form with confidence and ensure compliance with tax regulations.