In today’s digital age, it is essential to stay updated with the latest trends and requirements when it comes to legal forms and documentation. One such form that has undergone recent changes is the 1099 NEC form for the year 2020. This printable form is a necessary document for those who need to report non-employee compensation.

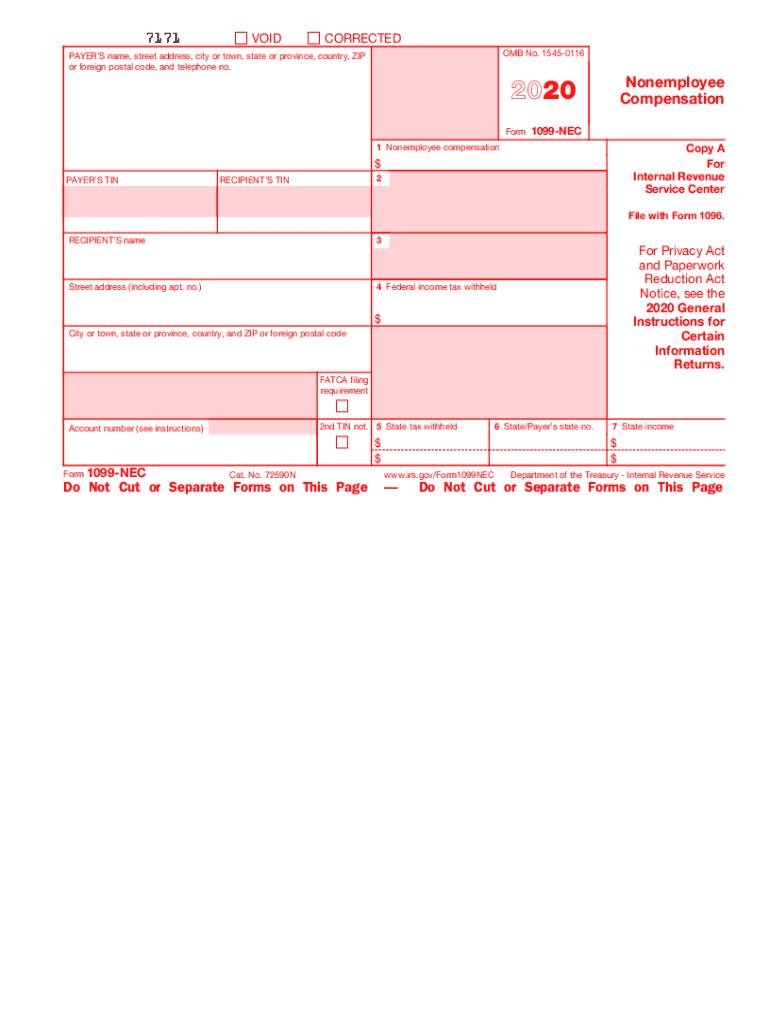

1099 NEC Form 2020 Printable - Printable World Holiday

The 1099 NEC Form 2020 Printable is an important tool for individuals and businesses alike who are looking to accurately report their non-employee compensation for the year. This printable form allows individuals to easily fill in the required information and submit it to the appropriate authorities.

The 1099 NEC Form 2020 Printable is an important tool for individuals and businesses alike who are looking to accurately report their non-employee compensation for the year. This printable form allows individuals to easily fill in the required information and submit it to the appropriate authorities.

Free Printable 1099 NEC Form - Printable Forms Free Online

Thanks to the availability of free printable 1099 NEC forms online, individuals and businesses can now access and complete their forms with ease. These printable forms offer a convenient solution for those who prefer a hard copy of their documents or need them for reference purposes.

Thanks to the availability of free printable 1099 NEC forms online, individuals and businesses can now access and complete their forms with ease. These printable forms offer a convenient solution for those who prefer a hard copy of their documents or need them for reference purposes.

What Is A 1099? Explaining All Form 1099 Types - CPA Solutions

Understanding the different types of Form 1099 is crucial when it comes to accurate reporting. CPA Solutions provides in-depth explanations of all Form 1099 types, including the 1099 NEC, to help individuals and businesses comply with IRS regulations. By learning about each form’s specific requirements, taxpayers can ensure they are reporting their income correctly.

Understanding the different types of Form 1099 is crucial when it comes to accurate reporting. CPA Solutions provides in-depth explanations of all Form 1099 types, including the 1099 NEC, to help individuals and businesses comply with IRS regulations. By learning about each form’s specific requirements, taxpayers can ensure they are reporting their income correctly.

For the Love of 1099s! Preparing for JD Edwards Year-End – Circular

Preparing for year-end can be a daunting task, especially when it comes to tax forms like the 1099 NEC. Circular provides valuable insights and resources for individuals using JD Edwards software. Their comprehensive guide helps businesses navigate the complexities of year-end reporting and ensures accurate completion of the 1099 NEC form.

Preparing for year-end can be a daunting task, especially when it comes to tax forms like the 1099 NEC. Circular provides valuable insights and resources for individuals using JD Edwards software. Their comprehensive guide helps businesses navigate the complexities of year-end reporting and ensures accurate completion of the 1099 NEC form.

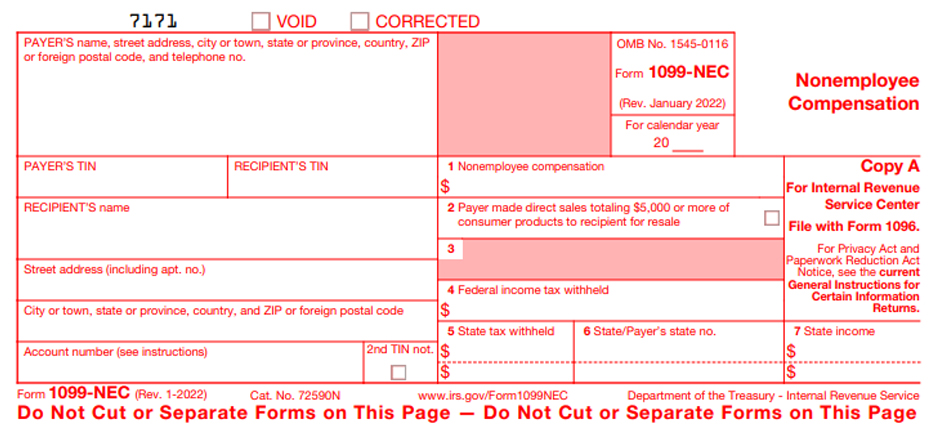

Free Printable 1099 NEC Form 2022 - Printable Word Searches

As we approach the year 2022, it is essential to stay updated with the latest versions of the 1099 NEC form. Printable Word Searches offers a free printable version of the 1099 NEC form specifically designed for ease of use and accuracy. With this printable form, taxpayers can ensure they are reporting their non-employee compensation correctly, while also saving time and effort.

As we approach the year 2022, it is essential to stay updated with the latest versions of the 1099 NEC form. Printable Word Searches offers a free printable version of the 1099 NEC form specifically designed for ease of use and accuracy. With this printable form, taxpayers can ensure they are reporting their non-employee compensation correctly, while also saving time and effort.

E-file Form 1099-NEC for 2022 | File Nonemployee Compensation Online

For those who prefer to file their tax forms online, E-file Form 1099-NEC provides a convenient solution. This online platform allows individuals and businesses to quickly and securely file their non-employee compensation forms for the year 2022. By utilizing this service, taxpayers can eliminate the hassle of paper forms and ensure accurate and timely reporting.

For those who prefer to file their tax forms online, E-file Form 1099-NEC provides a convenient solution. This online platform allows individuals and businesses to quickly and securely file their non-employee compensation forms for the year 2022. By utilizing this service, taxpayers can eliminate the hassle of paper forms and ensure accurate and timely reporting.

Form 1099-NEC is an essential document that many individuals and businesses need to file to comply with IRS regulations. Understanding the different types of Form 1099s, utilizing printable versions for convenience, and exploring online filing options are key steps in ensuring compliance and accurate reporting. Stay informed, stay organized, and stay ahead of tax requirements with these valuable resources and tools.

Understanding 1099 Form Samples

1099 Form Samples provide a visual representation of the different sections and information required on the 1099 NEC form. By understanding these samples, taxpayers can gain clarity on how to accurately fill out the form and report their non-employee compensation. Oracle’s comprehensive guide provides detailed insights and examples to help users navigate through the form effectively.

1099 Form Samples provide a visual representation of the different sections and information required on the 1099 NEC form. By understanding these samples, taxpayers can gain clarity on how to accurately fill out the form and report their non-employee compensation. Oracle’s comprehensive guide provides detailed insights and examples to help users navigate through the form effectively.

What is Form 1099-NEC and Who Needs to File? – 123PayStubs Blog

123PayStubs Blog offers a comprehensive explanation of Form 1099-NEC and who needs to file it. By providing valuable information and guidance, individuals and businesses can ensure they meet the necessary requirements to report non-employee compensation accurately. This blog post serves as an essential resource for those looking for clarification on their filing obligations.

123PayStubs Blog offers a comprehensive explanation of Form 1099-NEC and who needs to file it. By providing valuable information and guidance, individuals and businesses can ensure they meet the necessary requirements to report non-employee compensation accurately. This blog post serves as an essential resource for those looking for clarification on their filing obligations.

[最も選択された] form 1099-nec schedule c instructions 231161-How to fill out

This informative guide provides step-by-step instructions on how to fill out Form 1099-NEC, specifically for Schedule C. By following these instructions, taxpayers can ensure they accurately report their non-employee compensation while complying with IRS guidelines. This resource is a valuable tool for those who need additional guidance on completing the form correctly.

These various resources and tools make it easier for individuals and businesses to navigate the complexities of the 1099 NEC form. Whether you prefer printable versions that offer convenience and ease of use or online filing options for a faster and more streamlined process, there is a solution for everyone. Stay informed, stay organized, and meet your tax obligations with confidence.